Longtail got short shrift

McLaren’s glorious road car had a brief spell at the top in endurance racing before its rivals gained an unfair advantage Wandering about Silverstone on a recent test day we…

It’s a scene familiar to generations of Formula 1 fans: settling down to watch the live grand prix broadcast on any given Sunday. However, this year that will be reserved for those willing to pay for the privilege, as live race coverage disappears behind a paywall.

This season, fans without a Sky Sports subscription will be able to watch only one race in all its live glory – the British Grand Prix. Outside that they will have to make do with highlights shows on Channel 4.

The reason for the loss of live coverage inevitably revolves around big money contracts and, to many people involved in the sport, the net result of the restricted access is simple: fewer people will be watching. This has raised fears that the move behind a paywall could do lasting damage to the reputation of the sport and to other forms of motor racing as potential future competitors and viewers turn away from it.

At a time when motor sport of all types is struggling to attract new blood and fighting an increasingly cut-throat battle with other forms of entertainment, more barriers to audience and participation are poorly timed.

“I think fans will feel it,” says veteran F1 commentator Ben Edwards, who has voiced the sport since he joined the BBC in the mid-1990s and will be part of C4’s package for this coming year. “I can’t see it as anything but a negative for the sport. When you’re on free TV you have a very big potential audience and both the BBC and C4 were always very pleased with their viewing figures for both live F1 coverage and the highlights shows.

“It is fundamentally damaging to the sport [if] it’s less accessible, and if something is less accessible then less people are talking about it and the less in the public eye it becomes. If F1 goes completely behind a paywall and becomes an elitist thing to watch, that would be very disappointing.”

Live F1 is disappearing from British screens this year due to the broadcasting rights being sold exclusively to Sky by Bernie Ecclestone, just months before Liberty Media bought F1’s commercial rights in late 2016. Some critics consider the TV deal as Ecclestone’s last gift to the sport. He negotiated the agreement to hand the UK TV rights exclusively to Sky from 2019 right up until 2024. While not negotiated by Liberty, the five-year agreement will undoubtedly be a financial bonus for F1 in a commercial sense, with Sky forking out around £1.2billion for the exclusivity – equating to around £200m per season.

The deal is great for the sport’s coffers in the short-term – after all both Liberty and the teams will benefit from TV revenue sharing across the grid. However, the reduction in viewing figures a move behind a paywall inevitably brings could do lasting damage over the longer term, with smaller audiences leading to less gravity to pull in big-money sponsors.

Liberty is aware of the division between the easy cash of per-per-view rights versus the mass market benefits of free-to-air TV. Its commercial director Sean Bratches says: “FTA is critically important to us. My vision as it relates to media rights is a hybrid of FTA and pay. Our plan is to balance the two but have a prominent, over the year, free-to-air voice. That is important from a fans, sponsors and relevance standpoint.

“There is a cauldron of cash on the pay side and on the other side of the scale you have brand and reach. My view is a 70-30 model of FTA to pay, where you have a number of grands prix on FTA and then we can play and toil with the pay side to generate revenue that we can reinvest into the sport.”

That “70-30 split” is essentially what the UK will have this year, but with that 30 percent being the crucial factor to look at. F1 will not disappear completely from FTA TV in this country this year, but it is perilously close to doing so. The new agreement only has the mandate for a single race to be shown live this year over a FTA broadcast, and with Sky owning the exclusive rights, it also has control of the secondary highlights packages that in this case amount to that other 30 per cent. For 2019, Sky has effectively sub-let those to be shown on Channel 4, after some extended bartering that includes C4 shows being made available to Sky customers, and vice versa.

The deal ensures that F1 retains FTA coverage for this year, but so far only extends to this year. If Sky chose to do so, those highlights could easily switch away from a mainstream broadcaster in the longer term – to perhaps Sky One or another subsidiary channel – removing F1 coverage from ‘the big three’ FTA broadcasters entirely.

The consequence of taking racing off free TV entirely are clear to see when you look at the experiences of other countries.

Take Italy, for example. Last year free coverage almost entirely disappeared for Italy, which is traditionally F1’s second-largest global market. National station Rai has covered F1 since 1953, and often shown the entire season live. During 2017 it showed nine races live – mirroring the UK’s previous deal. During 2018 Liberty sold the exclusive rights to Sky Italia, which put the vast majority of races behind a paywall and showed four live races and highlights via its FTA subsidiary, TV8. It was effectively like removing races from the BBC in the UK and putting them on a dramatically lesser-watched channel, such as Quest.

The average audience figures for races fell starkly – down from 4.6m to 2.92m, in year one alone. That’s a stat that won’t sit well with F1 mainstay Ferrari, as well as its monied sponsors. Plus, that figure is undoubtedly hiked by the one race Rai did air live – the Italian GP, which attracted a huge 5.5m domestic viewers.

Italy’s situation is a dangerous indicator for the UK, should it follow suit. Mark Wilkin is a producer who worked for both the BBC and C4’s F1 coverage, having started in the mid-1980s. He more recently worked for the Whisper Films company, which will produce this year’s C4 highlights shows.

Wilkin says: “We can learn from what’s happened in Italy and it’s pretty clear from history in other territories that if FTA coverage goes, the audience for the subscription services rarely increases hugely in response. That means that main audience – the FTA one – simply stops watching the sport, and that’s hugely damaging.

“Losing the grand audience, the families with kids and grandparents all watching, is dangerous. It’s important for the drivers, to be superstars and be recognised and mobbed on the street and to transcend from the back pages of the papers to the front.”

F1 fans can still take solace in the fact that every race this year will still receive FTA coverage of the highlights shows, which have fared relatively well in the viewing figures.According to figures from the Broadcasters’ Audience Research Board (BARB), which is jointly owned by a host of broadcasters – including the BBC, C4 and Sky – C4’s live races out-scored the highlights audiences, but not by as much as you’d think. Live races averaged a viewership of 2.65m in the UK, with highlights shows averaging 2.07m, lagging just 580,000 behind. The highlights of the Hungarian GP even topped C4’s weekly viewing chart with 2.14m people tuning in. Had it not been for smash hits such as The Great British Bake Off or Gogglebox, races like the German, Spanish and Italian GPs would have also topped the ratings chart on their respective weeks.

“Where are the next generation of fans going to come from if they don’t find F1 on TV?”

Some argue that a residual love of the sport among British audiences will prevent the sort of fall in viewing figures experienced in Italy. However, the loss of live F1 coverage will still be felt keenly, according to Motorsport UK chairman David Richards.

“The key thing is that our viewing habits are changing,” Richards says. “Kids are far more likely to watch sport on a mobile than sit in front of the TV for a few hours. Also, when did you last watch a recorded sporting activity? It comes down to the fact that we’re conditioned by an immediacy of information the modern world provides us. We’re not prepared to wait and, if something has happened, the chances are we already know about it as the information is everywhere and the event has lost its immediacy. Live TV for sport is absolutely essential and there’s no way of getting around that.”

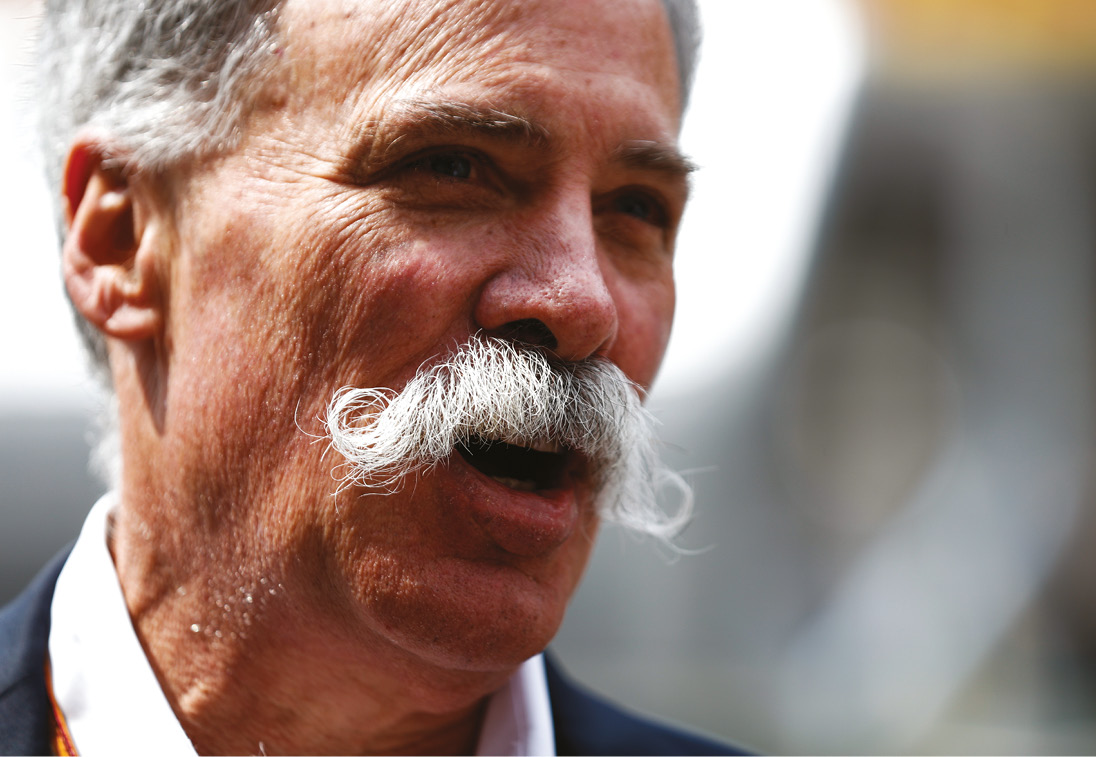

Liberty’s introduction of its F1 TV Pro streaming service is a case in point for it trying to take the sport to more audiences. F1 TV Pro was rolled out to around 60 countries last year, offering what Liberty describes as “Over The Top” coverage via its own subscription service. Liberty funded its development, which was beset by issues after a delayed launch in time for May’s Spanish GP. Liberty head Chase Carey described the first year as “a beta test” ahead of a bigger and better service for 2019 onwards. While Sky’s rights deal prevents its use in the UK – as it also does in Italy – it could well make an impact here in future. Regardless, it’s another pay-per-view option.

F1 could also look at the variable plight or success of other sports behind a paywall for clues to the future.

For success, look at Premier League football. Essentially created as a pay-per-view business, it is now the most profitable football league in the world, and its fourth most-valuable sporting franchise – behind American Football (NFL), basketball (NBA) and baseball (MLB). It only enjoys highlights shows via FTA, with no live terrestrial coverage in the UK. Yet, it’s so popular that fans can still follow it easily without even actually watching a game, such is the saturation of media coverage.

On the downside, take British cricket. Test matches disappeared entirely behind a paywall to Sky back in 2006 and the sport has endured a steady drop in audience since. Sky’s final day Ashes coverage of just over 450,000 pales into comparison with the 8.2m C4’s equivalent attracted back in 2005.

Cricket also provides stark evidence that fears about a lack of accessible TV coverage can hit a sport below the surface. Sport England has shown a link between a reduction in viewership and participation. A 2017 study titled Active People found there to have been a 32 per cent drop in the number of people aged over 16 participating in cricket since its move to pay-per-view. The decline has even forced the hand of the England & Wales Cricket Board, which was insistent that some of the rights to its new Twenty20 tournament be shown FTA, as will two test matches. The BBC picked up part of that deal, worth an estimated £1.1bn alongside Sky, with ECB chief Tom Harrison saying cricket “had no ambition to be the richest, most irrelevant sport in the country.”

Could a total loss of FTA coverage threaten a similar decline in motor sport?

“The cricket analogy is not lost on me, and there’s a lesson to be learned there,” says Richards. “If cricket has experienced a drop in participation it could easily happen to other sports. Ultimately, the more a sport is seen and the more it is promoted, the more likely people are to take part in it. Liberty and F1’s teams will be keenly aware of the need to stimulate activities at the lower end of the sport also, and Motorsport UK are always looking for new opportunities to do the same and promote the grassroots levels with internet campaigns and mobile content.

“The perception of F1 is also a double-edged sword. While it’s great to have the sport seen and made available to a wider audience on TV, if somebody were to only perceive motor sport to be F1 then they will have a very blinkered approach to the sport as a whole. They will likely see it as something that is unattainable, very exclusive and something they could never take part in.”

It’s important to point out that Sky isn’t the evil faction here. Arguably F1 is better catered for than ever before because of its coverage, and the resources and budget Sky has committed only reinforces its belief in F1 to be a world-class spectacle. Sky’s dealings with C4 are purely on commercial and business grounds. Sky clearly wanted to do a deal with C4, but at the same time must also protect its own investment. Plus it’s offering the F1 channel for just £10pm, but you still need the basic Sky package.

Richards has the last word: “For the enthusiasts, they will always watch F1 and will seek out the best coverage – and that is undoubtedly Sky’s. The production is superb, but it does cater for the enthusiast.

“But you do have to wonder, where are the next generation of enthusiasts going to come from if they don’t stumble across a grand prix while flicking through the TV channels? That’s a concern to us all.”